Overview

Stryker is committed to supporting your financial well-being — today and tomorrow. The Stryker Corporation 401(k) Savings and Retirement Plan helps you prepare for retirement by offering an easy, tax-advantaged way to save for your future financial needs.

Key advantages:

Company match of 50% of the first 8% of your eligible pay that you contribute

Opportunity for additional discretionary company contributions for non-sales representatives

Current tax saving

A Roth feature that allows you to pay tax on your deferrals today and enjoy tax-free withdrawals in retirement

A Roth In Plan Conversion feature

Tax-deferred investment growth

Wide range of investment choices

Manage your account

Visit https://retirementplans.vanguard.com/ to enroll or manage your plan account:

- Enroll in the plan

- Check your balance

- Change your contribution rate

- Manage your investments

- Update your beneficiary

- Use planning tools and calculators

- Request or model withdrawals and loans

What if I don’t enroll?

You are immediately eligible upon your date of hire. If you don’t take any enrollment action—either enrolling yourself or opting out—within 90 days of becoming eligible, you will be automatically enrolled, and 3% of your eligible before-tax pay will be deducted and invested in the Vanguard Target Retirement Trust appropriate for you based on a retirement age of 65. Additionally, each March (or a month of your choice) the deferral rate will be increased by 1%, until the deferral rate reaches 15%. You may enroll at a higher rate, change the investment allocation or opt out of the 401(k) at any time after you receive your welcome letter from Vanguard.

You may change your contribution rate and investment elections at any time by calling 800 523 1188 or visiting https://retirementplans.vanguard.com/.

Your contributions

You can choose to make pre-tax contributions, Roth after-tax contributions or a combination of pre-tax and Roth contributions. You may contribute between 1% and 75% of your eligible pay to your account, up to annual IRS limits. Eligible pay generally includes your salary, commissions and bonuses. See the Summary Plan Description for more information. Your combined pre-tax and Roth contributions cannot exceed IRS limits.

In 2026, you may contribute up to:

- $24,500 if you are under age 50

- $32,500 if you’re age 50 or older this year (which includes an additional $8,000 in catch-up contributions)

- $35,750 for those aged 60-63

Catch up!

If you’ll be 50 or older this year, take advantage of the opportunity to save more as noted above by using the 401(k) Catch-Up Contribution Form.

When complete, open a case in myHR and attach the form.

Stryker's contributions

To help you reach your retirement planning goals, Stryker makes the following contributions to your account.

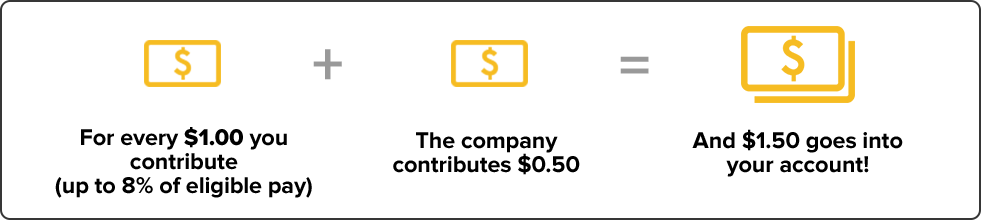

Company matching contributions

To support your retirement saving efforts, we match 50% of the first 8% of your eligible pay that you contribute. Eligible pay generally includes your salary, commissions and bonuses. See the Summary Plan Description for more information.

To receive a matching contribution, you must be employed on the last day of the plan year and must have at least 1,000 hours of service during the plan year. Matching contributions are calculated at the end of each plan year, and are credited to your account in the first quarter of the following year.

Here’s how the company match works:

Meet the match!

Try to contribute at least 8% of your eligible pay that you contribute to take full advantage of the match — otherwise, you’re simply missing out on free money. To change your contribution, visit the https://retirementplans.vanguard.com/ website.

Discretionary company contributions

Depending on company performance, Stryker may make an additional discretionary contribution to your plan account — whether or not you choose to contribute. Sales representative roles are not eligible for discretionary company contributions.

Vesting

Vesting is another way of saying “how much of the money is yours to keep if you leave Stryker.” You are always 100% vested in your own contributions, including any investment gains and losses on the money. The vesting schedule for company contributions is shown below. Note that you receive a year of service for each calendar year in which you work at least 1,000 hours.

| Years of service | Vesting percentage |

|---|---|

| Less than 2 | 0% |

| 2 years | 20% |

| 3 years | 40% |

| 4 years | 60% |

| 5 years | 100% |

Have you named a beneficiary?

It’s important to designate a beneficiary to receive the value of your 401(k) account in the event you die before beginning to receive your benefit. As personal circumstances change, be sure to keep that information up to date. Visit https://retirementplans.vanguard.com/ or call 800 523 1188 to add or change a beneficiary.

Withdrawals and loans

The money in your account is intended as a long-term investment to help you prepare for your financial needs in retirement. However, under certain circumstances, you may be able to access money from your account before reaching retirement age. For more information and to initiate an application, visit https://retirementplans.vanguard.com/ or call 800 523 1188.

Think before you act

If you’re considering taking a withdrawal or loan from your plan account, be sure to think about the impact it may have on your financial future.

Taking money from your account now

may lead to a smaller savings balance when you retire.

Not only are you taking money away from your retirement savings,

but the burden of repaying the loan may make it even harder to get back on track.

If you take a plan loan, you’ll also lose more money to taxes

because the interest payments on your loan are made with money that has already been taxed, and it will be taxed again when withdrawn from your account.

If you withdraw before-tax money from your plan account,

in addition to paying current taxes on the money, you may have to pay an additional 10% penalty tax if you are younger than age 59½ or, age 55 if you have retired or left the company.

Tools and resources

Make the most of your retirement planning by taking advantage of these tools and resources:

Ayco Online Tools and Financial Coaching

Our financial wellbeing partner, Ayco, helps you manage your finances. Plan for your future by accessing Ayco's online tools or participate in financial coaching that's tailored to your individual concerns and needs.

Ayco can help you:

- Prioritize expenses

- Achieve a financial goal

- Create an investment plan

- Determine how much to save in your Health Savings Account or 401(k)

Vanguard Retirement Income Center

Use the Vanguard Retirement Income Center to access retirement calculators and toolkits to help you make informed investment decisions. If this is your first time, visit the Vanguard registration page to register your account. Your plan number is 090081.

Financial Engines® Personal Online Advisor

Get an objective view of your investment portfolio and independent, online investment advice at no cost to you. Access by logging on to your https://retirementplans.vanguard.com/ account.

Lyra Health: Mental Health and Employee Assistance Program Financial Planning Resources

The mental health and employee assistance program offers tips, tools and expert advice for personal budgeting, money management, saving and investing.

Summary Plan Description (SPD)

Plan provisions vary based on your role at Stryker, and the benefits are described in two separate SPDs:

- The 401(k) Plan for Non-Sales Representative Employees

- The 401(k) Plan for Sales Representatives

You can access both in the Summary Plan Description.

Before investing, carefully consider the investment options’ objectives, risks, charges and expenses. Call 800 523 1188 for a prospectus and, if available, a summary prospectus, or an offering circular containing this and other information. Please read them carefully.

Investing involves risk, including the risk of loss.